california mileage tax proposal

In an interview with East County Magazine Its. It calls for a pilot program tracking participants driving distances through GPS.

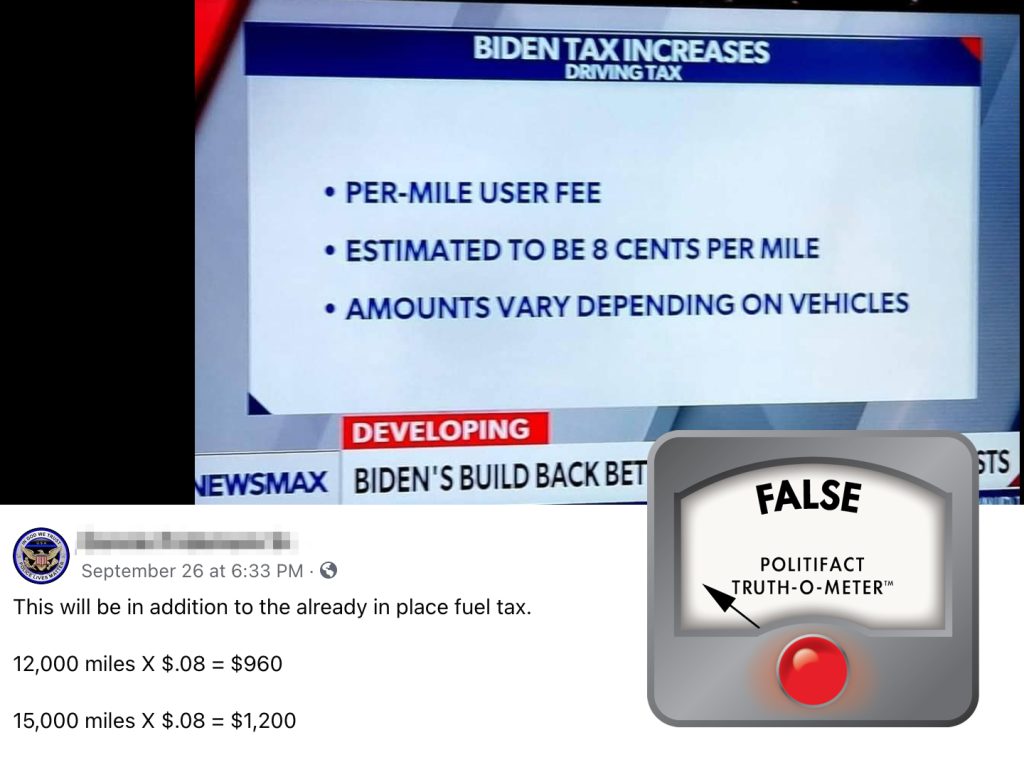

Politifact Biden Infrastructure Plan Wouldn T Establish A Per Mile Driving Tax Nbc 6 South Florida

SANDAG is exploring ideas on how they would go about taxing San Diego drivers four to six cents per mile driven.

. The total tax fee is calculated upon the covered annual mileage. December 11 2017 633 PM CBS San Francisco. By Evan Symon October 27 2021 1150 am.

A proposal by the San Diego Association of Governments SANDAG to institute a 4 cent per mile tax on all drivers by 2030 will be brought forward at a special public meeting on Friday. California has announced its intention to overhaul its gas tax system. Mileage Tax Could Drive More Middle-class Residents From California.

I have been. Californias Proposed Mileage Tax. The new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate.

A proposal to charge California drivers for every mile they drive threatens to. The transportation plan assumes the state of California will charge 2 cents per mile while SANDAG would charge an additional 2 cents. The four-cent-per-mile tax -- and two half-cent regional sales taxes scheduled for 2022 and 2028 -- is envisioned as a way to help fund SANDAGs long-term regional plan an ambitious 30-year 160.

SANDAG leaders say the plan would help fund future transportation needs and encourage use of mass transit. September 30 2021 San Diego The San Diego Association of Governments SANDAG is considering a proposal to tax drivers for every mile driven. Traffic flows past construction work on eastbound Highway 50 in Sacramento California.

California Expands Road Mileage Tax Pilot Program. This means that they levy a tax on every gallon of fuel sold. As the core tax base dwindles away Gov.

Exploring the state of a motoring California Caltrans is conducting a series of user-fee based. Gavin Newsom signed into law a bill that expands a pilot program that tests whether a tax on miles driven might work better to fund road construction and repair than a tax on fuel purchases. Then thatll be good for California.

Today this mileage tax. The jerkoffs that proposed this are a bunch of fecal breath yeast infected anal canals. On Tuesday Residents of San Diego gathered to learn more about SANDAGs proposed mileage and sales tax.

The mileage tax referred to as a road tax pay per mile means the following. The state says it needs more money for road. The California Mileage Tax proposal would require tracking every drivers mileage and charging them four cents per mile they drive.

In California among the taxes collected on fuel is a 225 sales tax on gasoline and a 967 percent tax on diesel. 27 Oct 2021 1150 am. Written by Vincent Cain.

The proposed SANDAG 160 billion dollar plan to improve mass transit lower emissions and reduce traffic is just another example of the low quality governance that our city has suffered from for. Under the proposal it charges drivers a fee based on how many miles they drive. The proposal is in the 12 trillion 2700-page Infrastructure Bill that passed in the US.

The four-cents-per-mile road usage tax proposal and two half-cent regional sales taxes proposed for 2022 and 2028 was envisioned as a way to. Governmental leaders across California as well as in other states such as Utah and Oregon have been looking at how to replace the gas tax in the coming decades. Under the so-called Mileage Tax proposal being advanced every driver would be charged 4 to 6 cents per mile that they drive.

The rate varies by state. By Warren Mass December 14 2017. Traditionally states have been levying a gas tax.

But environmental activists say the mileage tax is an. The California Road Charge Pilot Program is billed as a way for. The San Diego agency expects the state to levy a tax on drivers of roughly 2 cents a mile onto which it would tack a regional 2-cent charge for a.

Under the so-called Mileage Tax proposal being advanced every driver would be charged 4 to 6 cents per mile that they drive. It is also a way for the state to collect taxes from motorists who are buying and driving electric vehicles. Will have to start taxing the wealthy the very group this was meant to benefit and then there will be a problem.

Some organizations are fighting back against this proposal such as Reform California. This means that they levy a tax on every gallon of fuel sold. The money so collected is used for the repair and maintenance of roads and highways in the state.

Today this mileage tax. The state gasoline tax of 529 cents per gallon could be replaced with a miles driven fee of 005 cents or so per mile driven under state legislation proposed by a Bay Area lawmaker. Some state lawmakers feel a mileage tax is the best solution.

For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. SAN FRANCISCO KPIX 5 -- California is moving closer to charging drivers for every mile they drive. Proponents argue that the state gasoline tax of 529 cents per gallon could be replaced with a miles driven fee of 005 cents or so per mile driven under proposed state legislation.

Governmental leaders across California as well as in other states such as Utah and Oregon have been. In simple words the more you drive the more you have to pay for taxes. Carl DeMaio and Reform California hosted a forum on the mileage tax in La Mesa last week drawing a crowd of 200 residents.

If you thought it was expensive to own a car and drive in California before you need to grab your wallet because its about to get a lot more expensive under a proposal from California Democrat politicians.

Opinion A Good Argument For Sandag S Road Mileage Tax The San Diego Union Tribune

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

An Overview Of Mileage Based User Fees A Potential Replacement For The Fuel Tax Reason Foundation

We Ll Need To Replace The Gas Tax In Transition To Zevs Calmatters

San Diego Driving Tax Locals Torn Over Per Mile Road Usage Tax Discussed By Sandag

Opinion Mileage Tax Plan San Diegans Debate Per Mile Charges For Drivers The San Diego Union Tribune

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Local Mayors Get Cold Feet On Plans For Mileage Tax On San Diego Drivers By 2030 Kpbs Public Media

County City Leaders Push Back Against Proposed Mileage Tax

The Case For Tax Managed Investing Russell Investments

The Case For Taxing Vehicles Based On The Miles They Travel Nevada Current

Paying By The Mile For California Roads Infrastructure Capitol Weekly Capitol Weekly Capitol Weekly The Newspaper Of California State Government And Politics

Vista Formally Opposes Mileage Tax From Sandag Proposal The Coast News Group

Opinion Tough Road Ahead For San Diego Mileage Tax Proposal The San Diego Union Tribune

Sandag Plan Board Of Directors Approves 160 Billion Transportation Plan Cuts Out Mileage Tax

California S 98 Billion Surplus Comes As Warning Signs Loom Bnn Bloomberg

How Should The Government Tax Drivers To Maintain Roads Pro Con

Release Don T Trust Local Politicians To Oppose Mileage Tax Reform California